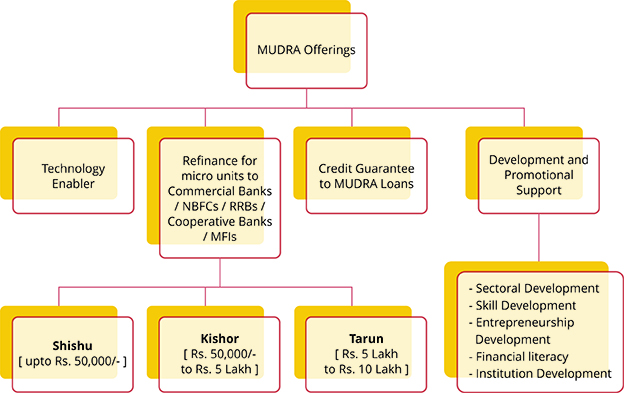

Pradhan Mantri Mudra Yojana is a special scheme set up by the Government of India through MUDRA (a subsidiary of SIDBI). MUDRA supports institution to extend loans to the non-corporate non-farm sector income generating activities of micro and small entities (subject to those enterprises with credit needs below 10 lakhs).

The interventions have been named ‘Shishu’, ‘Kishor’ and ‘Tarun’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur.

50,000/-

This stage would cater to entrepreneurs who are either in their primitive stage or require lesser funds in order to get their businesses started.

5,00,000/-

This section of entrepreneurs would belong to either those who have already started their business and want additional funds to mobilize their business.

10,00,000/-

If an entrepreneur meets the required eligibility conditions, he/she could apply loan for upto Rs.10 lakhs. This would be the highest level of amount that an entrepreneur could apply for a startup loan.

Under the aegis of Pradhan Mantri Mudra Yojana (PMMY), MUDRA has created products / schemes. The interventions have been named ‘Shishu’, ‘Kishor’ and ‘Tarun’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth to look forward to :

- Shishu : covering loans upto 50,000/-

- Kishor : covering loans above 50,000/- and upto 5 lakh

- Tarun : covering loans above 5 lakh and upto 10 lakh

It would be ensured that more focus is given to Shishu Category Units and then Kishor and Tarun Categories.

Within the framework and overall objective of development and growth of micro enterprises sector under Shishu, Kishor and Tarun, the products being offered by MUDRA are so designed, to meet requirements of different sectors / business activities as well as business / entrepreneur segments.

The funding support from MUDRA are of four types :

- Micro Credit Scheme (MCS) for loans upto 1 lakh finance through MFIs.

- Refinance Scheme for Commercial Banks / Regional Rural Banks (RRBs) / Scheduled Co-operative Banks

- Women Enterprise programme

- Securitization of loan portfolio

Micro Credit Scheme :

Micro Credit Scheme is offered mainly through Micro Finance Institutions (MFIs), which deliver the credit upto Rs.1 lakh, for various micro enterprise activities. Although, the mode of delivery may be through groups like SHGs/JLGs, the loans are given to the individuals for specific income generating micro enterprise activity. The MFIs for availing financial support need to enroll with MUDRA by complying to some of the requirements as notified by MUDRA, from time to time.

Refinance Scheme for Banks

Different banks like Commercial Banks, Regional Rural Banks and Scheduled Cooperative Banks are eligible to avail of refinance support from MUDRA for financing micro enterprise activities. The refinance is available for term loan and working capital loans, upto an amount of 10 lakh per unit. The eligible banks, who have enrolled with MUDRA by complying to the requirements as notified, can avail of refinance from MUDRA for the loan issued under Shishu, Kishor and Tarun categories.

Women Enterprise Programme

In order to encourage women entrepreneurs the financing banks / MFIs may consider extending additional facilities, including interest reduction on their loan. At present, MUDRA extends a reduction of 25bps in its interest rates to MFIs / NBFCs, who are providing loans to women entrepreneurs.

Securitization of loan portfolio

MUDRA also supports Banks / NBFCs / MFIs for raising funds for financing micro enterprises by participating in securitization of their loan assets against micro enterprise portfolio, by providing second loss default guarantee, for credit enhancement and also participating in investment of Pass Through Certificate (PTCs) either as Senior or Junior investor.

Purpose of MUDRA loan

Mudra loan is extended for a variety of purposes which provide income generation and employment creation. The loans are extended mainly for :

- Business loan for Vendors, Traders, Shopkeepers and other Service Sector activities

- Working capital loan through MUDRA Cards

- Equipment Finance for Micro Units

- Transport Vehicle loans

Following is an illustrative list of the activities that can be covered under MUDRA loans:

Transport Vehicle

Purchase of transport vehicles for goods and personal transport such as auto rickshaw, small goods transport vehicle, 3 wheelers, e-rickshaw, passenger cars, taxis, etc.

Community, Social & Personal Service Activities

Saloons, beauty parlours, gymnasium, boutiques, tailoring shops, dry cleaning, cycle and motorcycle repair shop, DTP and Photocopying Facilities, Medicine Shops, Courier Agents, etc.

Food Products Sector

Activities such as papad making, achaar making, jam / jelly making, agricultural produce preservation at rural level, sweet shops, small service food stalls and day to day catering / canteen services, cold chain vehicles, cold storages, ice making units, ice cream making units, biscuit, bread and bun making, etc.

Textile Products Sector / Activity

Handloom, powerloom, khadi activity, chikan work, zari and zardozi work, traditional embroidery and hand work, traditional dyeing and printing, apparel design, knitting, cotton ginning, computerized embroidery, stitching and other textile non garment products such as bags, vehicle accessories, furnishing accessories, etc.

Business loans for Traders and Shopkeepers

Financial support for on lending to individuals for running their shops / trading & business activities / service enterprises and non-farm income generating activities with beneficiary loan size of upto 10 lakh per enterprise / borrower.

Equipment Finance Scheme for Micro Units

Setting up micro enterprises by purchasing necessary machinery / equipments with per beneficiary loan size of upto 10 lakh.

Activities allied to agriculture

‘Activities allied to agriculture’, e.g. pisciculture, bee keeping, poultry, livestock, rearing, grading, sorting, aggregation agro industries, diary, fishery, agriclinics and agribusiness centres, food & agro-processing, etc.(excluding crop loans, land improvement such as canal, irrigation and wells) and services supporting these, which promote livelihood or are income generating shall be eligible for coverage under PMMY in 2016-17.

https://www.mudra.org.in/offerings